One school budget – three weeks – three price tags

Harwood tax forecast improves (slightly) as H.850 becomes law

February 23, 2024 | By Lisa ScagliottiHarwood’s proposed $50.8 million budget for the 2024-25 school year in the past three weeks has had three different estimated price tags for taxpayers – without the budget changing a penny.

That’s the latest takeaway from the most recent information used in discussions around the bill H.850 that the state Senate passed this week and Gov. Phil Scott signed in short order on Thursday. The new law was drafted and enacted this month as lawmakers acted quickly to amend Act 127, the new state education funding formula unveiled this year.

The new measure repeals Act 127’s controversial cap on the homestead school tax rate for school districts that kept their per-pupil spending increases for 2024-25 below 10% while keeping a new system for counting student enrollment. In place of the cap, H.850 offers a reduction in tax rates for the districts that are losing their taxing capacity under Act 127. The Harwood Unified Union School District is one such district.

But in the process of adopting H.850, a new detail in the data from the state Agency of Education since late last week has produced yet another change that affects the funding formula calculation. This tweak is a glimmer of good news for the Harwood district because the estimated tax increases now look not quite as severe as they did just a week ago.

The increases are still higher than the initial estimates that used the now-repealed tax cap, and school officials caution that this factor undoubtedly will change again before the dust settles on Vermont school budgets this spring.

It’s also unclear which direction it will go in next.

Tax implications change – again

Scroll over to see values

Source: HUUSD data as of Feb. 21, 2024 | Graphic by Julia Bailey-Wells

At Wednesday night’s Harwood School Board meeting, Superintendent Mike Leichliter and Finance Manager Lisa Estler offered the board an update on the action at the State House. The school board just last week on Feb. 14 met and considered the implications of H.850 which was moving quickly given the upcoming March 5 Town Meeting Day school budget votes. Lawmakers wanted to make the changes to Act 127 to allow school boards to revise their budget proposals before voters weigh in. Revised budgets at this late date, however, would mean postponing votes until later in March or early April.

Harwood’s board considered the change in Act 127 coming from the state and opted to leave its budget proposal as-is and proceed with the March 5 vote as planned.

School district officials Wednesday told the board about a change to a key detail in Agency of Education information used in presentations to state senators late last week as they considered H.850. Leichliter described it as “an example of how fluid this state budget challenge is.”

In a conversation with The Valley Reporter, Leichliter said he learned that a key data point that the state gives school districts to calculate their budgets’ tax implications had changed – but this detail had not yet been shared with school districts. Harwood officials checked with the state Education Agency, Leichliter said, and they were told by the state source, “well, we were going to share it with you after [H.]850 passed.”

In a short slide presentation to the board, Estler explained that the detail involves the so-called “yield” figure that now is on its fourth iteration since Dec. 1. The yield, is “the amount of spending per equalized pupil that would result if the homestead tax rate were set at $1 per $100 of equalized education property value,” Estler said.

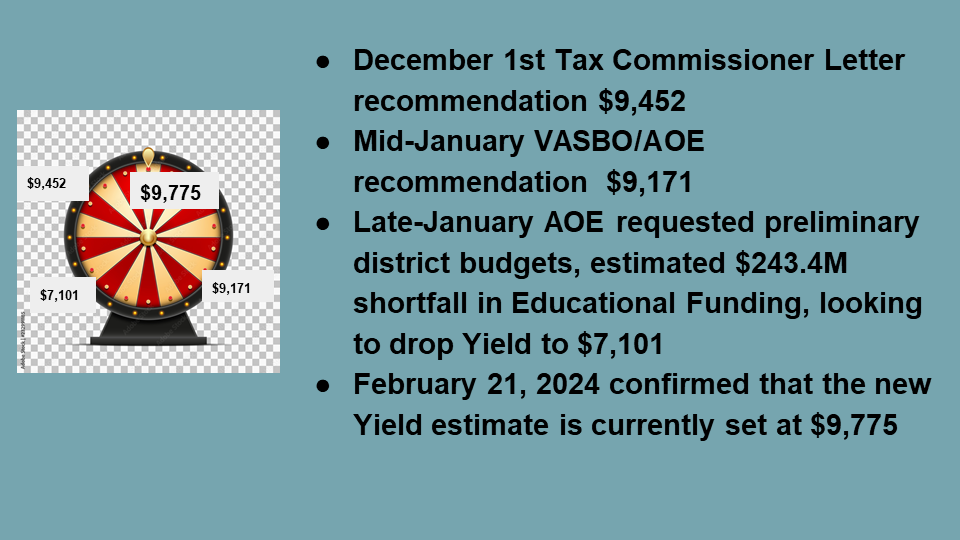

On the screen, she showed an image of a roulette wheel with four labels, each containing a different dollar figure representing a different yield value that the state has offered to school districts since Dec.1. “When they raise the yield, it helps the tax rate. When they lower the yield it impacts the tax rate negatively,” Estler said.

The latest value is higher than what the board used on Jan. 31 when it decided which version of the 2024-25 budget to put on the Town Meeting Day ballot, and again on Feb. 14 when it agreed it wouldn’t alter that proposal despite the tax cap being removed.

“And remember, the yield is not finalized until the end of spring, so it can change,” Eslter cautioned. It’s a part of the complex education funding puzzle that’s set by the legislature, she said. “It’s very difficult to estimate, and it’s driven by the financial status of the education fund and other political factors.”

One budget – three weeks – three tax scenarios

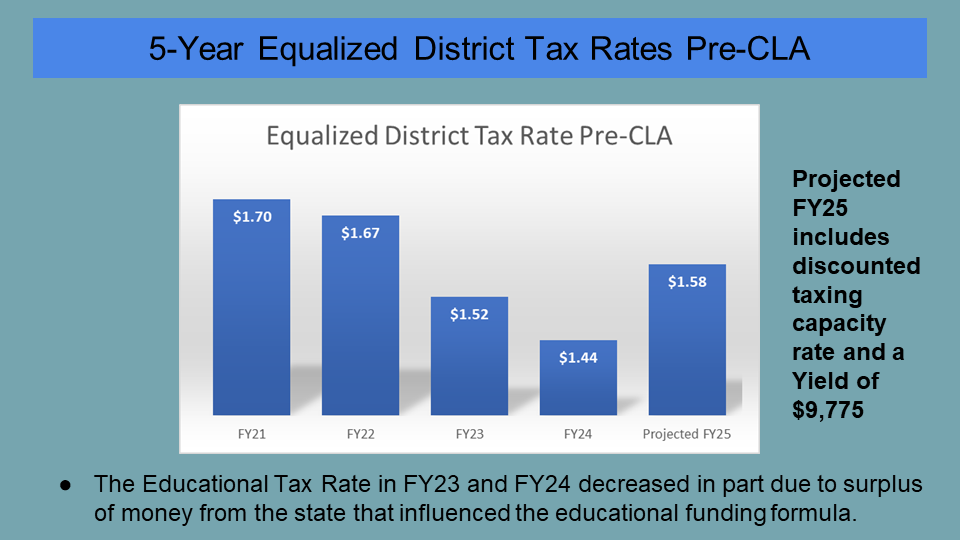

So, to recap, the Harwood school board adopted a $50.8 million budget for the March 5 ballot originally thinking that the homestead tax rate would be capped at a 5% increase or $1.51 per $100,000 of assessed property value. (That compares with the current rate of $1.44 supporting the 2023-24 budget.) The plan contained $1 million for the Maintenance Reserve Fund added in when it was clear that the cap meant the same tax rate applied for both a $49.8 million budget and the $50.8 million version.

These figures are before the Common Level of Appraisal is applied to the calculation to adjust for property assessments being lower than current real estate market levels.

Under the initial scenario, property taxes per town in the Harwood district were estimated to see increases between a low of 16.6% in Duxbury and 25.8% in Warren.

Tax example #1

Initially, Waterbury’s school tax increase was pegged at 20% or $389 per $100,000 of property value. So, for example, a home assessed at $300,000 would have seen its school taxes go up by $1,167. Duxbury’s value was the lowest at $316 and Warren’s highest at $509.

Then by Feb. 14, it was clear the tax cap was being eliminated. The Harwood board, however, decided against making any changes to its budget, although some argued for removing the $1 million for maintenance.

Tax example #2

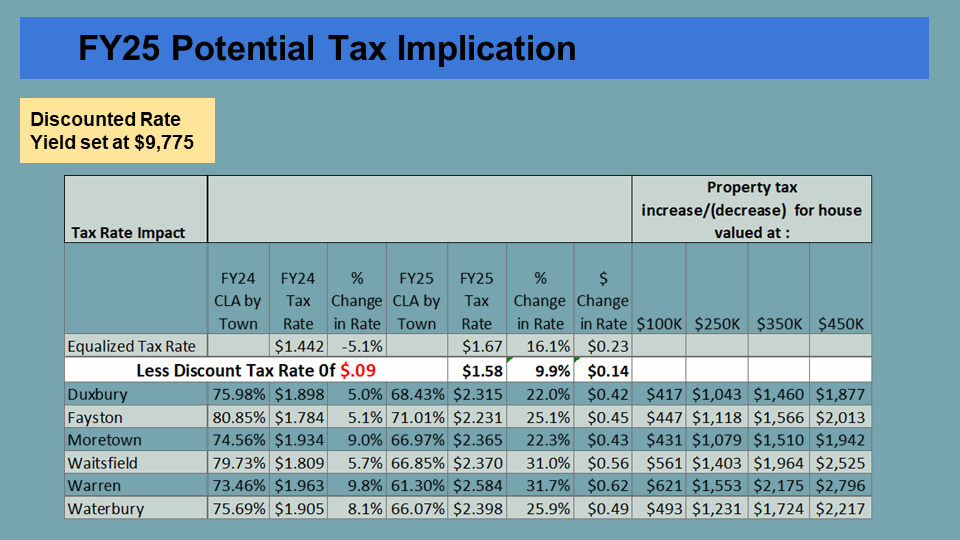

Without the cap, the homestead rate calculation went to $1.78, and then the new state guidance via H.850 would allow Harwood to discount that by 9 cents, bringing the tax rate to $1.69.

Then factoring in the Common Level of Appraisal, estimated tax rates shot up to 30%-40% for the same $50.8 million budget. Duxbury’s value remained on the low end, estimated at $570 per $100,000 property value; Warren was on the high end at $794; Waterbury’s was in between at 34% or $653. The estimated tax increase for that $300,000 Waterbury home: $1,959.

And now this week, as the state crunches numbers using its fourth version of the yield factor, Harwood’s estimated tax increases have landed in between the first and second scenarios. Estler’s calculation for Wednesday’s school board meeting now shows the six towns’ projected increases falling between 22% and 32% – still extraordinarily high.

Tax example #3

Still using the unchanged $50.8 million budget, the latest figures (as of Feb. 23) for tax increases range from a low for Duxbury at $417 per $100,000 of property value to a high of $621 for Warren. Waterbury’s 26% increase would mean $493 more per $100,000 in value, making the school tax bill for that $300,000 home go up $1,479.

School board members received the news and had no further discussion of the matter.

Estler promised to keep the board updated as information changes. Voters in the Harwood district will consider the proposed budget on Town Meeting Day, March 5. A second question on the ballot asks voters to authorize putting the 2022-23 school year surplus of $535,000 into the district’s Maintenance Reserve Fund to pay for facility repairs and maintenance.

The district’s annual meeting, which will include a budget presentation and votes on routine housekeeping measures, will be held at 6 p.m. on Monday, March 4, in the Harwood Union library and online via Zoom and the district’s YouTube channel. The public is encouraged to attend to learn more and ask questions. Details including the online links are on the district’s Annual Meeting Warning.

Slide presentation to HUUSD School Board on Feb. 21

Slides by HUUSD Finance Manager Lisa Estler presented to the school board this week.

For more reporting on H.850 clearing its final legislative hurdle on Wednesday and lawmakers’ comments on further reform needed in education funding, see this post on VtDigger.org.

See more on the Harwood budget including links to the annual report and details on the annual meeting in this earlier post.