The new and ‘improved’ CLA

May 3, 2024 | By Jack HoffmanThe 1973 oil embargo prompted many energy-saving ideas—real and imaginary. Daylight savings was extended year-round, which was spoofed in a cartoon of President Richard Nixon demonstrating an energy-saving blanket. He was shown cutting a strip from one end of the blanket and sewing it back on to the other end.

The current plan to reform Vermont’s notorious CLA—Common Level of Appraisal—looks a lot like Nixon’s blanket. It doesn’t actually change how things work, it just makes them look a little better to the public. The latest version of the yield bill now in the Senate changes the way the CLA is calculated but doesn’t actually change the way the CLA works or affects tax bills.

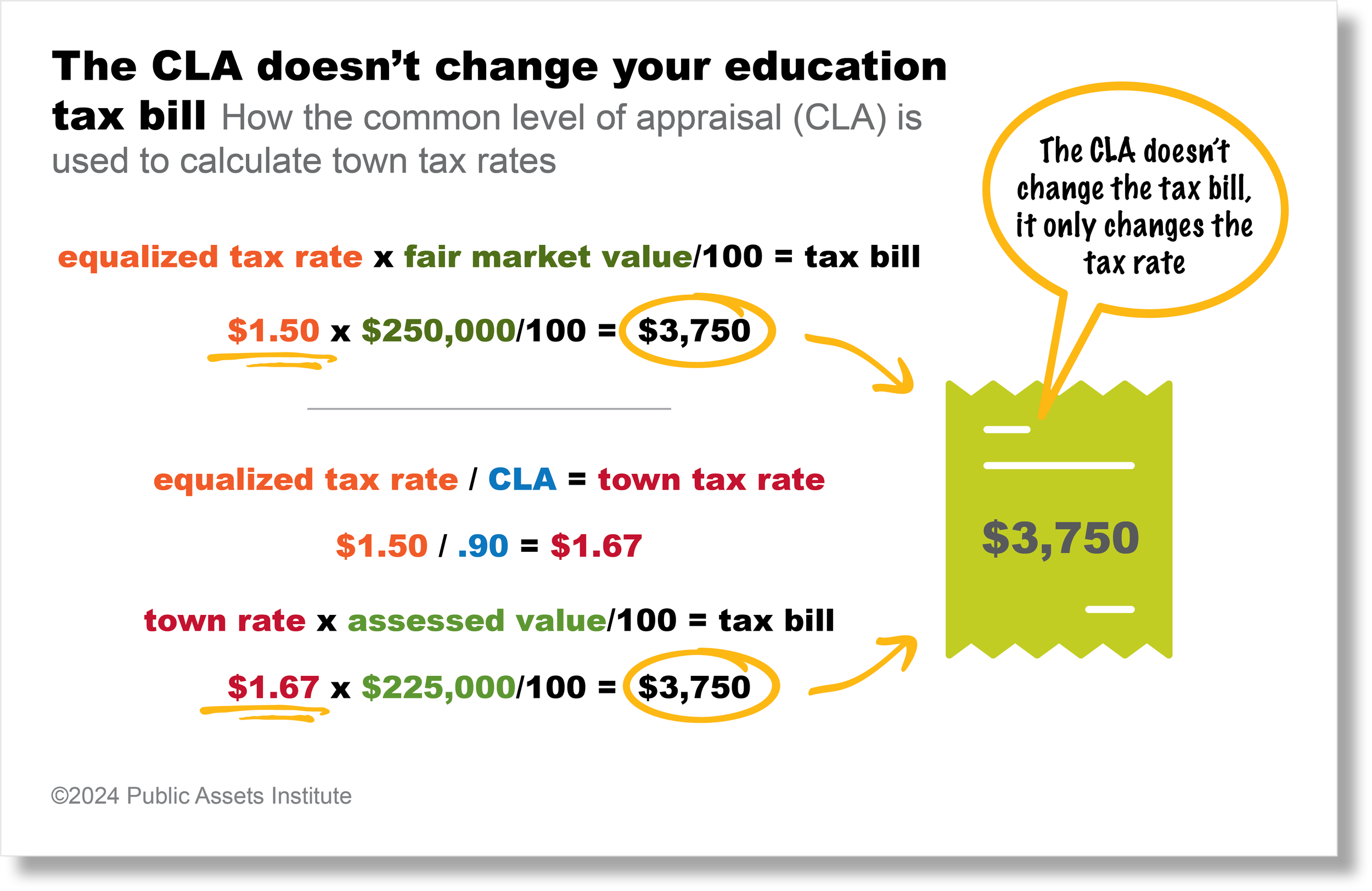

The CLA is misunderstood to begin with. It affects school tax rates at the town level, but not school tax bills. The CLA is part of the process to ensure fairness in the property tax system. For taxes to be fair, property needs to be evaluated against a uniform standard—a “common level of appraisal.”

Townwide reappraisals of individual property are expensive, so they are done periodically. But each year the state determines the aggregate fair market value of each town. Based on those values, the Legislature determines the tax rates—known as “equalized tax rates”—that will generate the revenue needed to help fund public education.

But because towns reappraise property at different times, the official assessed or “listed” values on the Grand List are typically less than fair market values. The CLA is the mechanism to adjust for the gap between the two values: it is the ratio of the listed value to the fair market value. In a town with a 90% CLA, the total listed value of property is 90% of the state-calculated fair market value. If property values go up between reappraisals, the CLA goes down. The lower the CLA, the bigger the gap between the assessed value and fair market value.

So when the state sets tax rates for the year, they’re setting a lower rate because they’re assuming a higher property value than the town listed amount. That means the town tax rate is higher than the rate set by the state, but it’s applied to a lower value, resulting in the same bill.

The CLA requires a little math, and it can be confusing, but it’s become a bugaboo because it’s so often used as a scapegoat. Many factors affect town tax rates: changes in per-pupil spending, changes in other revenue sources, changes in property values. But it’s so much easier to blame the CLA.

Even though the CLA is not well understood, the Legislature seems to have concluded that voters don’t like it when they think their CLA is too low, when there is too big of a gap between the listed value and fair market value. So they have devised a formula that will increase all of the CLAs and change equalized tax rates, but leave town tax rates unchanged.

In the end, tax bills won’t change with the redefinition of the CLA. The only difference will be that the CLA will appear to be higher—just as Nixon’s blanket appeared to be bigger.

Jack Hoffman is Senior Analyst at Public Assets Institute, a non-partisan, non-profit organization based in Montpelier. He is a resident of Marshfield currently living in France.